My Portfolio: 23Q4

- Moral Capitalist

- Jan 5, 2024

- 8 min read

Updated: Jul 1, 2024

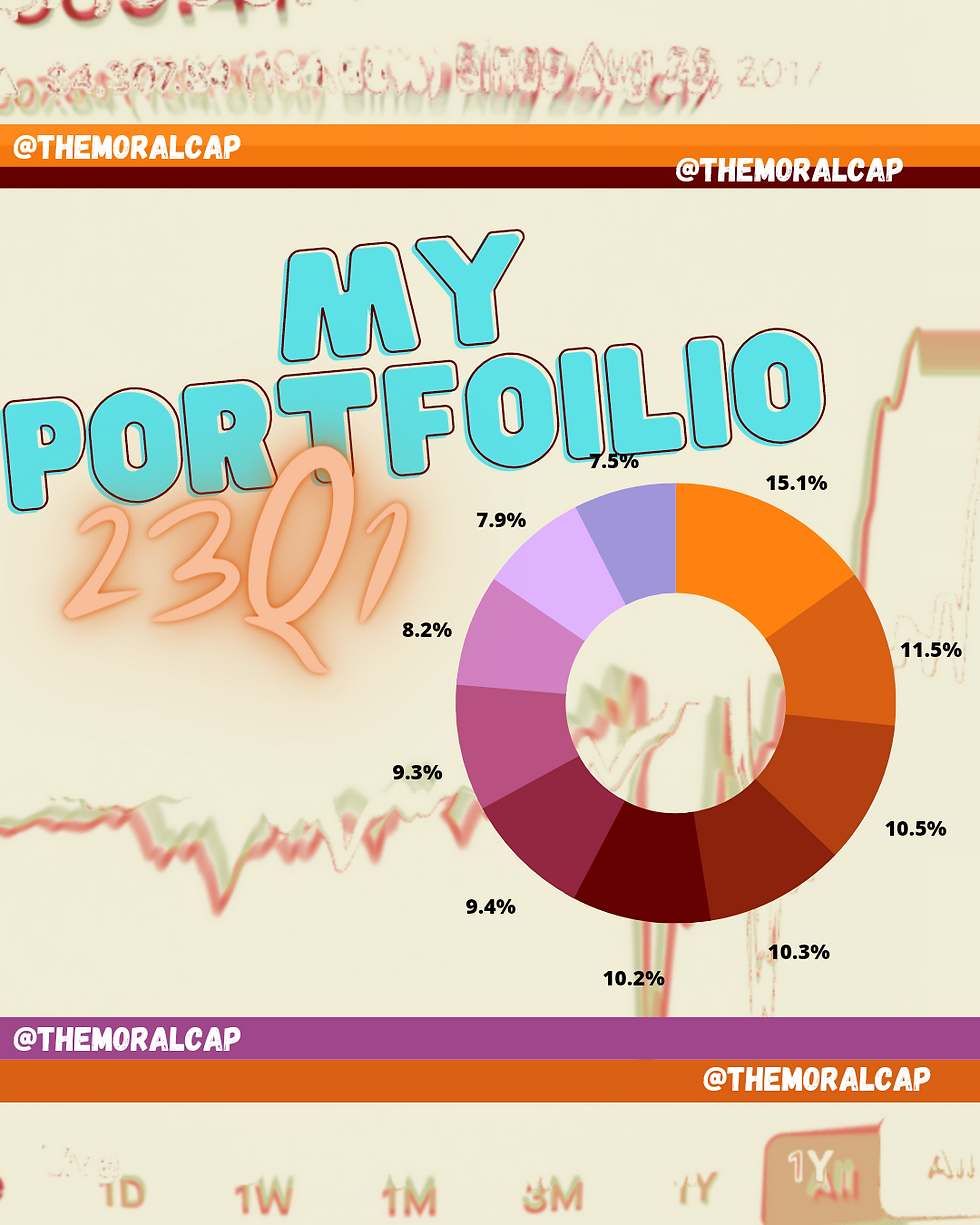

This issue of My Portfolio is a summary of my financial situation for the 2023 Q4. The other posts (previous quarters) can be found at links at the bottom of the webpage, under Continue Reading. Recap covers the main point of the previous quarter. Portfolio/ Investments cover my current portfolio in more depth. After, is a summary and perspective of the current environment. If there is anything you want to know feel free to ask in the comments.

Want to read more?

Subscribe to welephantsolutions.com to keep reading this exclusive post.